DevOps Security: Challenges and Best Practices

With the shift from traditional monolithic applications to the distributed microservices of DevOps, there is a need for a similar change in operational security policies. For…

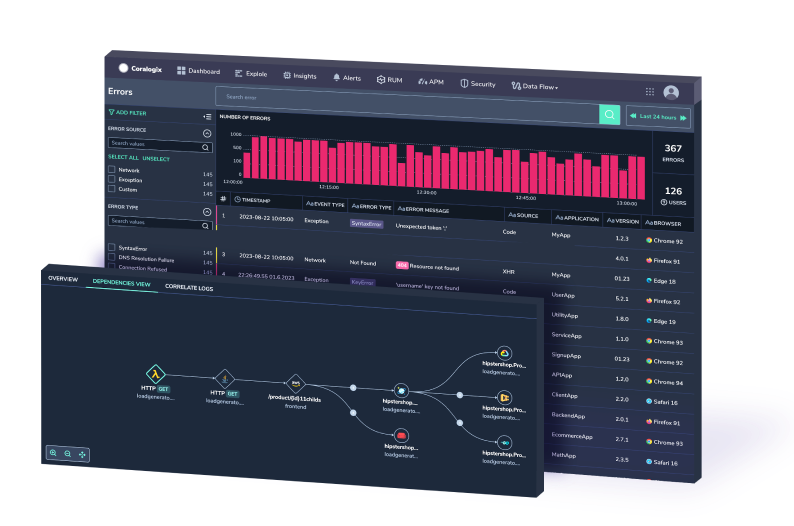

In the world of DevOps and continuous delivery, Log Analytics tools are quickly emerging as a crucial component for an effective strategy towards improved maintenance procedures and support of complex cloud infrastructures.

Just to provide a scale; the software maintenance market is estimated at around $140B annually, among which, $3B are invested annually in log management alone, with an amazing predicted growth rate of 12% a year for the next 5 years.

The complexity of log data and the scale of production systems are constantly increasing, making the traditional methods of writing log files and manually investigating them no longer adequate to analyze production systems.

The main challenge of Log Analytics companies is to simplify this process by using practical visualization methods and search tools that allow users to filter out noise and get the insights they need.

After years in which Splunk ruled supreme with its on-premise solution, Loggly’s SaaS alternative rose and was quickly adopted by the market, forcing Splunk to come out with its own SaaS solution “Splunk Storm”.

Following Loggly’s success, companies like LogRhythm, SumoLogic, and Logentries emerged and launched their own SaaS solutions for Log Analytics, each company with its own approach.

Loggly: The classic Log Analytics tool.

Provides powerful search and visualization tools, allows integration with other products but the focus remains on Log Management.

Loggly announced that it raised $15M in series C:

Loggly’s round C

LogRhythm: A security-oriented product (SIEM) with less value to maintenance purposes

Provides strong pattern matching and report capabilities for security purposes, the drawback, however, is the solution’s price, which is quite higher than the competition

LogRhythm announced that it raised $40M in series E:

LogRhythm round E

SumoLogic: Unstructured big data management software.

Provides statistic views and data aggregation technologies with their prime feature of “Log Reduce”, lately SumoLogic expanded their solution to the areas of business intelligence and security in order to place themselves as an alternative to Splunk (hard to miss the imagination between the two products)

SumoLogic announced that it raised $30M in a venture investment, and they intend to go through an IPO in the future:

Sumo Logic venture investment

LogEntries: A relatively light Log Analytics tool

Provides automatic log collection, log search and personal tagging of logs, those who wish to use Logentries for more complicated analytics will mostly fall short

Logentries announced that it raised $10M in series A:

LogEntries round A

All in all, it’s safe to assume that the Log Analytics market is here to stay and will continue growing as software systems will become more complex.